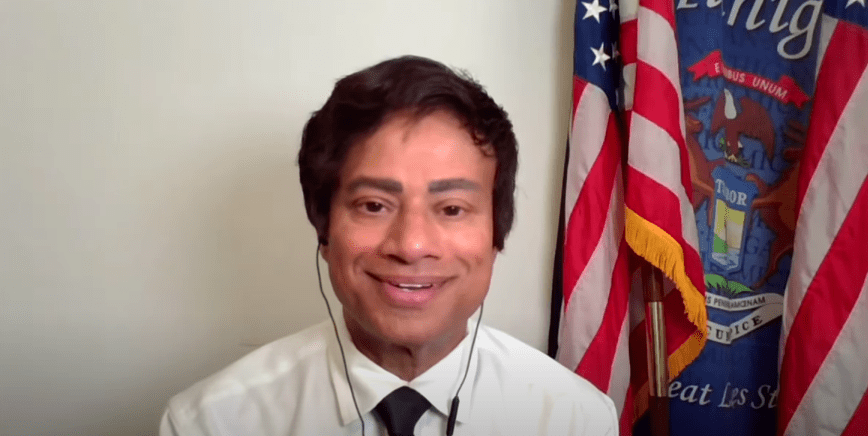

The financial rise of Representative Shri Thanedar is both purposeful and dynamic. According to Quiver Quantitative’s real-time tracking, the Michigan Democrat reportedly made an estimated $720,700 in stock market activity in a single month. Even though many members of Congress have financial interests, Thanedar has distinguished himself by being transparent and engaging in high-yield trading, which has placed him in a unique financial stratum where politics and portfolio management coexist remarkably well. Due to well-timed trades that demonstrate an exceptionally flexible investment strategy for an elected official, his portfolio is not only expanding but flourishing.

With an estimated net worth of $41 million as of May 18, 2025, Thanedar ranks 28th in terms of personal wealth among all members of Congress. Of this, about $7.7 million is invested in publicly traded assets that Quiver Quantitative keeps an eye on in real time. These assets are not idle holdings; rather, they are the catalyst for a string of deals that have produced above-market returns over an impressive period of time.

| Category | Details |

|---|---|

| Full Name | Shri Thanedar |

| Date of Birth | February 22, 1955 |

| Place of Birth | Belgaum, India |

| Nationality | American (Naturalized) |

| Education | Ph.D. in Chemistry, University of Akron; B.Sc. & M.Sc., University of Bombay |

| Political Party | Democratic Party |

| Current Office | U.S. Representative, Michigan’s 13th Congressional District |

| Term Start | January 3, 2023 |

| Previous Roles | Member, Michigan House of Representatives (2021–2023) |

| Entrepreneurial Career | Founder, Chemir Analytical Services |

| Business Exit | Sold Chemir in 2010 for $69 million |

| Estimated Net Worth | $41 million (as of May 2025) |

| Publicly Traded Assets | Estimated $7.7 million |

| Recent Market Gain | $720,700 (April 2025) |

| Notable Stock Trades | $APO, $AXP, $TSLA, $SBUX, $BIIB |

| Legislation Proposed | LIONs Act of 2025; H.R.2655 on unemployment tax |

| FEC Fundraising (Q1 2025) | $45.8K raised, $44.5K spent, $6.1M cash on hand |

| Reference | Quiver Quantitative – Shri Thanedar |

A particularly creative trend emerges when examining Thanedar’s financial choices: he left jobs at Apollo Global Management ($APO) and American Express ($AXP) in early 2023, just before each company’s stock rose by more than 90%. Either an exceptionally clear investment framework or an instinct that most market participants could only aspire to imitate is suggested by his strategic timing on these trades. However, not every move was a goldmine. The stocks of Biogen ($BIIB) and Starbucks ($SBUX) fell after he sold them, but the overall pattern shows that he consistently profits from rising markets.

Using his experience as an entrepreneur, Thanedar has developed a public image that combines political tenacity with business savvy. Decades of labor, beginning with his 1979 emigration from India to pursue a doctorate in chemistry, have been the foundation of his rise. He was a struggling bookkeeper’s son who worked nights to pay for his education before starting Chemir Analytical Services. The business eventually grew to be worth $64 million and sold for $69 million in 2010, which helped finance his foray into politics.

Among the notable bills Thanedar has introduced in Congress to sunset federal taxes on unemployment benefits are the LIONs Act of 2025 and H.R. 2655. Both bills show a progressive approach to economic justice and recovery, even though they haven’t yet changed the structure of the economy. His overarching objective of converting individual financial success into systemic change is in line with these initiatives.

Thanedar’s introduction of seven articles of impeachment against former President Donald Trump has also garnered significant national attention in recent weeks. Even though the political ploy garnered media attention, the reaction was quick and harsh, especially on social media. Instead of responding to the accusations, Trump’s followers became obsessed with his looks and made jokes like “sue your barber” that went viral. Despite their seeming absurdity, these ad hominem attacks highlight how performative and intensely personal American politics have become.

However, Thanedar’s tenacity is especially noteworthy. When pressure builds, he doesn’t back down or falter in the face of mockery. Indeed, it seems that his financial and political risks are aligned. He makes high-stakes bets in Congress that could either increase his influence or expose him to partisan backlash, much like he does with stocks like Tesla and AXP. His openness becomes a statement in this environment rather than merely a tactic.

Thanedar’s wealth is clearly self-made, in contrast to legacy politicians whose fortunes frequently come from oblique lobbying arrangements or generational inheritance. Not only is that distinction symbolic, but it also gives him a different public image. According to his financial disclosures, he relies very little on corporate or PAC donations; of the $45,800 he raised in the first quarter of 2025, 71.6% came from individual donors. He still has $6.1 million in campaign funds, which gives him a very effective political war chest going into future elections, even with that meager fundraising.

Thanedar is a change through strategic financial literacy and a solid understanding of public service mechanics. Voters are increasingly drawn to leaders who are disciplined in their personal financial management in addition to being skilled legislators. He thus joins leaders such as Senator Mark Warner or Governor Jared Polis, whose reputation in the private sector bolsters their public power.